In today’s fast-paced UAE business environment, effective billing isn’t just a back-office task it’s critical to cash flow, compliance, and customer trust. Whether you’re a distributor, retailer, or service provider, billing isn’t just invoicing: it’s about generating accurate, timely, and VAT-compliant documents that integrate into your broader enterprise system. That’s where a robust ERP like Enhance ERP comes in.

1. The UAE Billing Landscape Is Unique

One of the biggest reasons local businesses need specialized billing tools is VAT compliance. UAE VAT is set at 5%, and companies must ensure that their invoices clearly reflect VAT breakdowns, correct supplier and customer VAT Registration Numbers (TRNs), and other regulatory details. Traditional billing systems may struggle to keep up. With Enhance ERP, billing is deeply integrated with accounting, so VAT is calculated reliably, and invoices can be created without manual mistakes.

Beyond VAT, the UAE is also preparing for mandatory e-invoicing for B2B and B2G invoices starting July 1, 2026. Enhance ERP, being a full-fledged cloud or on-prem solution, is well-positioned to support digitally structured invoices, helping businesses stay ready and compliant.

2. Why Billing Must Be Part of Your ERP, Not a Standalone Tool

Many small businesses use standalone invoicing tools, but they often lack integration with inventory, purchasing, and financial reporting. Billing within an ERP system unlocks powerful advantages:

-

Real-time data flow: When you create a bill in Enhance ERP, that transaction flows into inventory and accounting modules — meaning stock levels are updated automatically, and revenues are tracked immediately.

-

Automation + Accuracy: Billing automation reduces manual data entry, minimizes human error, and speeds up invoice generation. As noted by ERP experts, modern ERP billing tools can generate, send, and track invoices more accurately while connecting to other business modules. Scalability: Whether you’re billing dozens or hundreds of clients, and issuing invoices daily or monthly, ERP-native billing scales with you.

3. Key Benefits of Using Enhance ERP for Billing in the UAE

-

Customizable Billing Workflows: Enhance ERP supports both SaaS and on-premise deployments. You can configure how your billing works from quote to final invoice to match your business.

-

Multi-Branch & Multi-User Support: If your business operates across multiple locations in the UAE (or beyond), you can centralize billing but allow local users to input data, generate invoices, or reconcile payments.

-

Security & Compliance: Billing data lives within Enhance ERP’s secure system. With centralized data, the risk of invoice tampering or lost billing info is reduced.

-

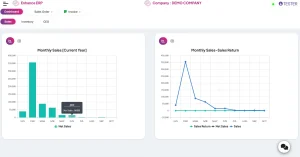

Analytics & Insights: Your billing and sales data feed directly into reporting dashboards. This gives you visibility into which customers are most valuable, what products are driving revenue, and which invoices are overdue, all in one place.

-

Improved Cash Flow: With automated reminders and tight integration with accounting, Enhance ERP helps you manage receivables more proactively. This means fewer late payments and better cash flow stability.

4. How to Implement Billing in Enhance ERP

-

Define Your Invoice Templates: Work with Enhance ERP’s team (or your implementation partner) to design your invoice layout—logo, VAT fields, invoice numbering, and customer data.

-

Set Up Financial & Tax Rules: Configure VAT settings, customer TRNs, and tax lines correctly in the system.

-

Train Your Team: Ensure your sales, finance, and operations teams know how to issue invoices, track outstanding payments, and reconcile invoices in the ERP.

-

Monitor & Iterate: Use the ERP’s reporting to watch payment trends, identify late-paying customers, and adjust your billing workflows.

5. The Bottom Line

In the UAE business world, billing isn’t just a task, it’s a strategic lever. When handled within a powerful ERP like Enhance ERP, billing becomes more accurate, automated, and tied directly to your business operations. That integration empowers you to be compliant, efficient, and ready for future requirements like mandatory e-invoicing. If you’re still managing invoices manually or using disconnected tools, upgrading to integrated billing through Enhance ERP could be a game changer for your cash flow and growth.