The idea that “accounting software is enough” for a growing B2B company is not just weak. It’s dangerous. It’s the kind of thinking that keeps founders busy instead of effective, and comfortable instead of scalable. If you believe your accounting tool can carry your business through growth, you are already behind. You just don’t know it yet.

This article will explain why. No fluff. No vendor worship. Just hard business logic.

Why Accounting Software Feels “Enough” at First

Let’s start with why so many B2B companies fall into this trap.

Accounting software does one thing very well. It records transactions. It tells you what happened after the fact. For early-stage companies, that feels sufficient because the business itself is simple.

Few products. Few customers. Low transaction volume. Minimal compliance pressure.

At that stage, accounting software feels like control. But it’s a false sense of control.

Accounting systems are built for reporting, not running a business. They answer “What happened last month?” They do not answer “What should we do tomorrow?”

The moment your business adds complexity, multiple warehouses, longer supply chains, credit terms, regional operations, or real forecasting, accounting software starts to crack.

And those cracks turn into operational debt very quickly.

Accounting Software vs ERP Software: Stop Confusing the Two

If you are still treating ERP software and accounting software as interchangeable, stop. That confusion alone tells me your internal processes are already messy.

Accounting software is a subsystem. ERP software is the operating system of the business.

ERP and accounting software serve different purposes.

Accounting software focuses on:

- General ledger

- Accounts payable and receivable

- Tax and statutory reporting

- Historical financial accuracy

ERP software focuses on:

- End-to-end business processes

- Real-time operational visibility

- Cross-functional integration

- Planning, control, and execution

When companies say “we’ll just connect a few tools,” what they really mean is “we’ll accept broken workflows and manual reconciliation forever.”

That is not a strategy. That’s procrastination.

The Real Problem: Growth Exposes Structural Weakness

Here’s the part most founders don’t like hearing.

Growth doesn’t create problems. Growth reveals them.

As transaction volume increases, manual work explodes. As product lines expand, data consistency collapses. As customer expectations rise, response times slow down.

Your accounting system cannot:

- Coordinate sales, inventory, procurement, and finance

- Enforce process discipline across teams

- Provide real-time margins by product, customer, or channel

- Support complex pricing, discounts, and credit terms at scale

This is where ERP software becomes non-negotiable.

Not because it’s fancy. Because without it, your organization runs on tribal knowledge and spreadsheets.

That is not scalable. That is fragile.

Supply Chain Reality Check for B2B Companies

If you operate in manufacturing, trading, or distribution and you are still relying on accounting software alone, I’ll be direct. Your supply chain is already inefficient.

Supply chain management ERP software exists for a reason.

Accounting systems record inventory values. ERP systems manage inventory behavior.

There’s a difference.

ERP software enables:

- Demand planning based on actual sales patterns

- Procurement planning aligned with lead times

- Inventory optimization across locations

- Lot tracking, batch control, and expiry management

- Supplier performance visibility

Without this, you are either overstocked, understocked, or both. Usually both.

For B2B companies in the UAE, this becomes even more critical due to import cycles, regulatory requirements, and regional distribution complexity. That’s why the best ERP software in UAE is not about brand prestige. It’s about local operational fit and execution discipline.

Wholesale and Distribution: Where Accounting Software Fails Fastest

Let’s talk about wholesale distribution ERP software, because this is where accounting-only setups collapse first.

Wholesale businesses deal with:

- High SKU counts

- Thin margins

- Complex pricing structures

- Volume-based discounts

- Credit-based sales

- Multi-warehouse fulfillment

Accounting software cannot manage this complexity in real time. It reacts after the damage is done.

ERP software enforces:

- Pricing logic at order entry

- Credit limits before shipment

- Inventory availability before promise

- Margin control before approval

If you are discovering margin leakage at month-end instead of preventing it at order entry, your system architecture is wrong.

Full stop.

Why Serious Companies Move to SAP ERP Software

Let’s address the elephant in the room.

Large and mid-sized enterprises don’t implement SAP ERP Software because it’s fashionable. They do it because complexity demands discipline.

Systems like SAP exist to:

- Standardize processes across entities

- Support regulatory and audit requirements

- Handle scale without chaos

- Enable data-driven decision-making

Is SAP for everyone? No.

Is ERP optional once you reach a certain scale? Also no.

The mistake is waiting until operations are already broken before implementing ERP. At that point, the project becomes painful, political, and expensive.

Early ERP adoption is a strategic decision. Late ERP adoption is damage control.

Why Accounting Alone Is Not Enough

Let’s structure this cleanly.

Accounting software fails growing B2B companies in four mutually exclusive and collectively exhaustive areas:

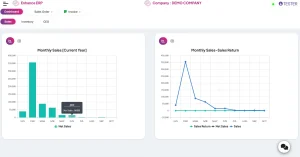

- Operational visibility

You cannot see what is happening in real time. - Process integration

Sales, procurement, inventory, and finance operate in silos. - Scalability

Manual work increases faster than revenue. - Decision quality

Decisions are based on lagging indicators, not live data.

ERP software addresses all four. Accounting software addresses only one, and even that incompletely.

When Should You Move to ERP Software?

Here’s the honest answer.

If you are asking the question, you are already late.

Practical triggers include:

- Multiple departments sharing spreadsheets

- Inventory discrepancies becoming “normal”

- Month-end close taking longer every quarter

- Leadership arguing over whose numbers are correct

- Growth slowing despite strong demand

ERP software is not a growth accelerator by itself. It is a growth enabler. Without it, you are driving a fast car with a fogged windshield.

Final Thought: Stop Optimizing the Wrong Thing

Accounting software helps you explain failure cleanly. ERP software helps you avoid failure altogether. Growing B2B companies don’t win by having perfect books. They win by having controlled operations, predictable execution, and reliable data.

If your core system cannot run your business end to end, it is not enough. No matter how comfortable it feels today.

If you want growth, stop thinking like a bookkeeper. Start thinking like an operator.

And operators run businesses on ERP, not hope and reconciliations.