The Essential Guide to Choosing the Best Accounting Software in UAE

In the vibrant and rapidly expanding business ecosystem of the UAE, robust financial management is non-negotiable for success. From managing daily transactions and payroll to ensuring VAT compliance and generating insightful financial reports, businesses need tools that are precise, efficient, and aligned with local regulations. This is precisely why selecting the right accounting software in UAE is a critical decision for any enterprise, regardless of its size or industry.

Navigating Financial Complexities in the UAE

The UAE’s economic landscape, characterized by its dynamism and specific regulatory framework, including the Value Added Tax (VAT), requires accounting solutions that go beyond generic offerings. Manual accounting methods are not only prone to errors but also time-consuming, diverting valuable resources from core business activities. A tailored accounting software streamlines these operations, providing accuracy, efficiency, and peace of mind.

Key Advantages of Specialized Accounting Software in UAE

- VAT Compliance: One of the most significant benefits is seamless VAT management. The software automatically calculates VAT on sales and purchases, generates VAT-compliant invoices and reports, and simplifies the process of filing VAT returns, ensuring your business stays compliant with UAE tax laws.

- Automated Bookkeeping: Reduce manual data entry and human error. The software automates tasks such as ledger entries, bank reconciliations, and expense tracking, freeing up your team to focus on strategic financial analysis.

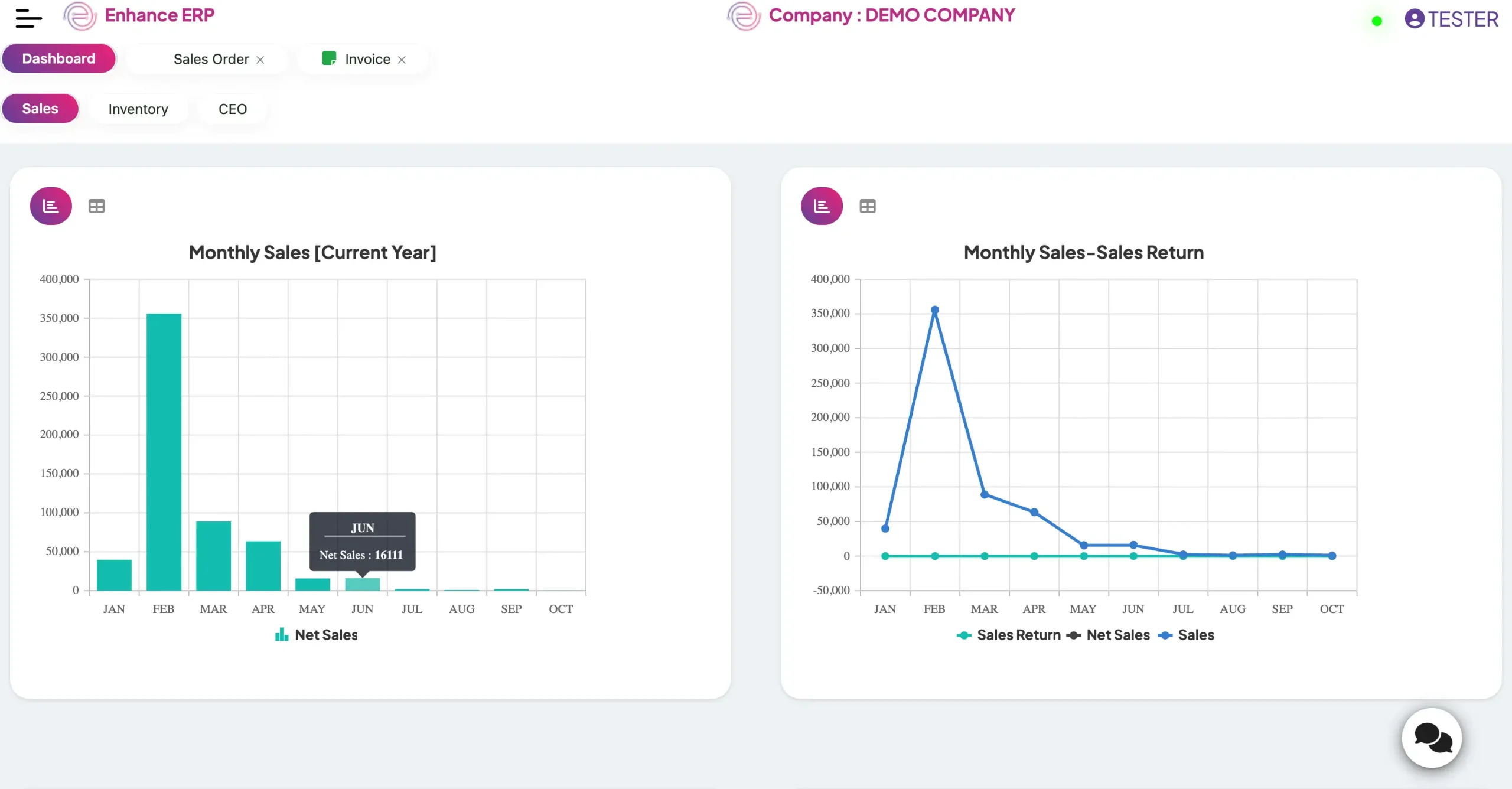

- Real-time Financial Insights: Gain an immediate and clear picture of your business’s financial health. Access up-to-date reports on profit and loss, balance sheets, cash flow, and more, enabling faster, more informed decision-making.

- Multi-Currency Management: For businesses dealing with international clients or suppliers, robust multi-currency support is essential. The software handles transactions in various currencies, automatically managing exchange rates and simplifying international trade.

- Simplified Payroll Processing: Many UAE-specific accounting solutions offer integrated payroll modules that comply with local labor laws, automate salary calculations, deductions, and end-of-service benefits, reducing administrative burden.

- Customizable Reporting: Generate a wide range of financial reports tailored to your specific needs. This helps in tracking key performance indicators, understanding cost centers, and planning future financial strategies effectively.

- Enhanced Security and Data Integrity: Protect your sensitive financial data with advanced security features, regular backups, and controlled user access, ensuring data integrity and preventing unauthorized access.

- Scalability: As your business grows, your accounting needs will evolve. The right software should be scalable, capable of handling increased transaction volumes and additional functionalities without compromising performance.

Choosing the appropriate accounting software in UAE is an investment in your business’s financial stability and growth. It not only streamlines operations but also provides the critical insights needed to navigate the competitive market successfully.